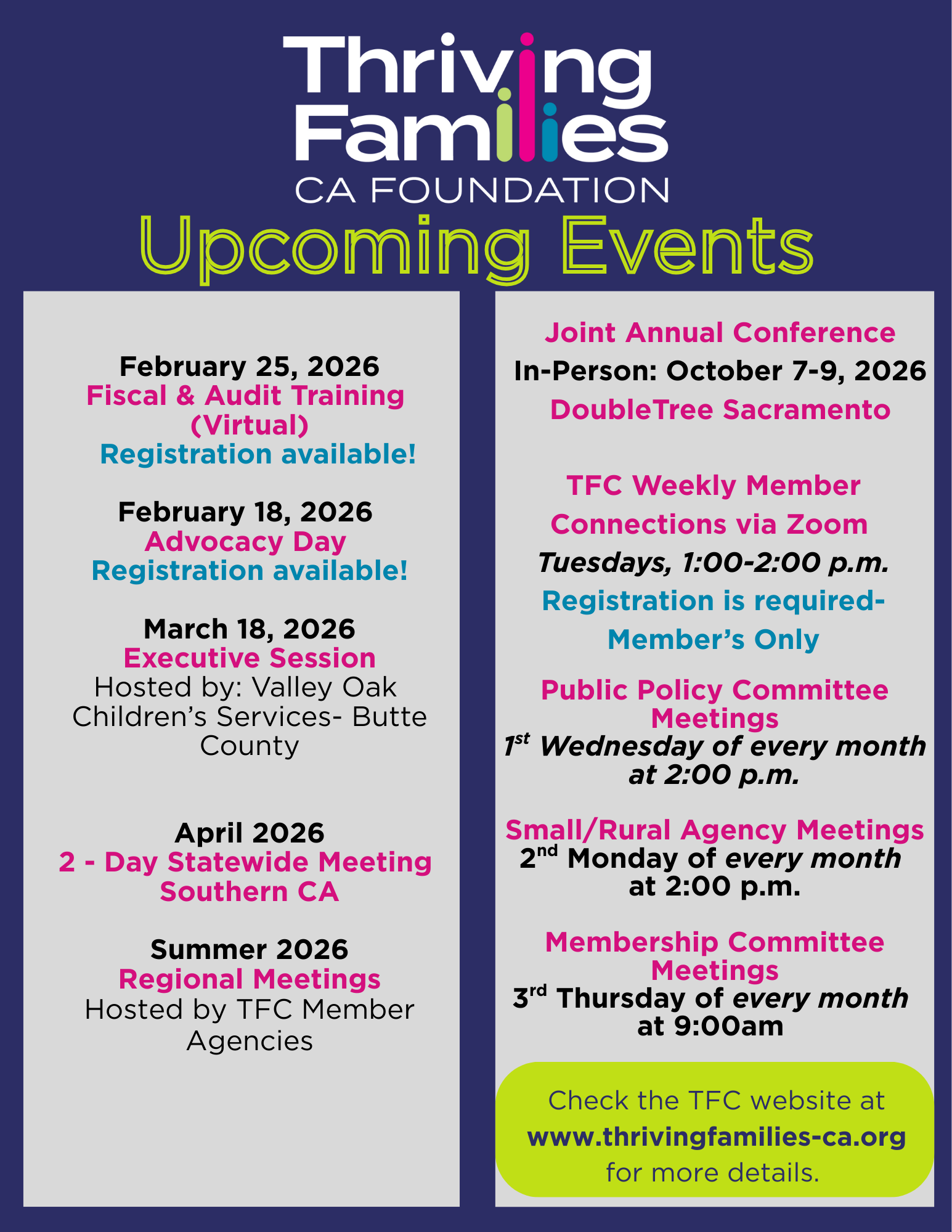

Save the Date!Thriving Families CA (TFC) Foundation is excited to announce an informational training event in Anaheim, designed to empower our community and foster collaboration. This Statewide Meeting presents a unique opportunity for participants to come together, share valuable insights and experiences, and explore innovative ideas that will shape policies and enhance best practices in our field. Over the course of two enriching days, attendees will have the chance to engage in a multi-track workshop format, catering to diverse interests and ensuring that every stakeholder finds relevant and impactful content. Together, we can strengthen our collective efforts to create THRIVING environments for children and families. We hope you can join us! |